- Private Market Review

- Posts

- Private Credit is still cooking

Private Credit is still cooking

Charts on spreads and structure, plus CMBS delinquency data, and the new factor that active managers want to try

The Big Picture in private capital markets

Headlines that matter: xAI, crypto-flows and the tokenization of everything, state endowment allocations, Vanguard enters the privates game

Three charts that matter: the Private Credit pricing premium; AI infrastructure financing boom; CMBS delinquency rates

A trade idea: Alpha in human capital

Trends & Analysis: ‘valuation reckoning,’ dollar-outlook, Figma S-1 teardown, and more on the AI energy theme

Decks & Data: Juniper Square on fundraising; Mid-year outlook from GSAM; Mid-year outlook from JPM

Private Market Review is a free newsletter for the smartest GPs, LPs and Allocators to keep tabs on the growing universe of alts, and the rotation to private capital markets.

Headlines 📰

Last minute twist on xAI deal adds a trio of banks. Morgan Stanley says the other banks were added at the behest of xAI (and not because anyone needed additional banks to market the deal).

Bitcoin’s appeal fades, as volatility hits 2-year low. Oh the irony. BTC is less attractive as prices stay relatively stable. Where’s the fun in that?

Investors pouring into tokenized Treasury Funds. Why buy stablecoins (backed by Treasuries), when you can buy tokenized Money Market funds? Apparently, clearing is both faster and cheaper, and tokenized MMFs are increasingly a useful form of collateral.

Fortress warns of possible default on $2B in bonds backed by Amazon Warehouses. The bonds were issued in 2020 at 2%. Now they need to be refinanced at much higher rates. Fortress is saying it might not get the refi done in time.

US public colleges expand PE investments despite downturn. The retreat by the Ivies, etc. is viewed as opportunity by others to get access that they previously could not get. This seems more like an “old dogs, new tricks” phenomenon than a strategic choice, but who knows.

Why Vanguard, Champion of Low-Fey Investing, Joined the Private Market Craze. HNW and retail are the new AUM land to conquer, and Vanguard already has access to 401ks, so it has no intention of missing out. Client-interest, however, has been (anecdotally) tepid.

Three Interesting Charts that Matter

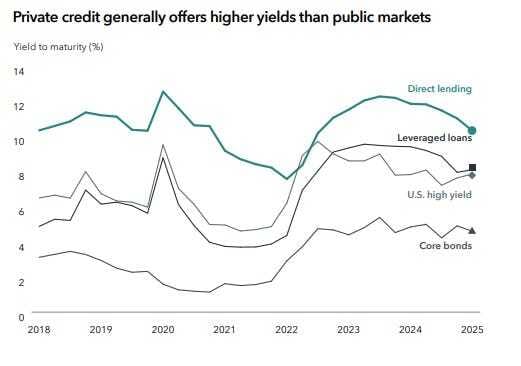

The Private Credit Premium

Private Credit continues to price ~150-200bps higher than publicly traded equivalents:

Spreads on private ABS are the widest in the debt markets and exceed the BSL market by a healthy margin.

Why it matters:

Private Credit has been one of the fastest growing asset classes, attractive for higher yields and shorter hold-times, relative to public debt, and private equity, respectively;

As the asset class gets bigger (and banks get competitive again), the concern is that pricing will compress, but the gap is still about as wide as it’s been;

Private Credit’s higher yields have been especially important for insurance company balance sheets, given the growth of retirement products—insurance capital is also preferred by lenders because, unlike deposits, it lacks the duration mismatch.

“Higher yields for the same risk” always generates healthy skepticism (as it should). When an asset class grows with relatively less transparency, and more financial engineering, the skepticism compounds (also, as it should). That said, the largest private credit platform do enjoy competitive advantages around speed, execution, and specialization—and, of course, privacy—that may readily explain the pricing premium. And, if the pricing premium disappeared, the bears would complaining about a race-to-the-bottom. So for now, it’s full-steam ahead.

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

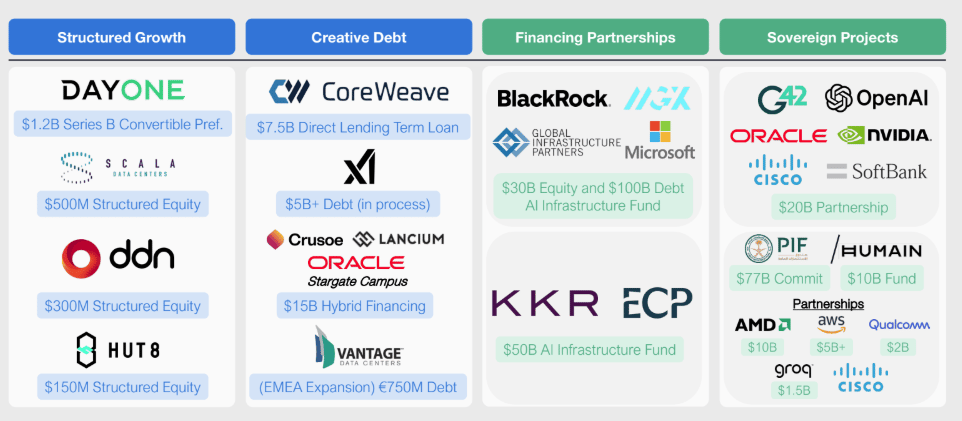

Who needs public markets, anyway?

The largest techcos have an increasingly large menu of sophisticated financing options in the private markets:

Coatue put together a mini-market-map, reflecting the scale and complexity of private debt offerings.

Why it matters:

Scale that outstrips traditional VC: multi-billion-dollar converts, term loans, and $30-100 B infrastructure funds reveal just how much capital next-gen AI/datacenter build-outs require (which would previously have been out of reach for private markets);

Tool-kit innovation: the mix of structured equity, hybrid debt, sovereign co-investment, and “creative debt” shows sponsors engineering bespoke capital stacks to fit everything from growth-stage startups (DayOne, CoreWeave) to megaprojects, lowering cost of capital while preserving flexibility;

Mainstream institutional buy-in: the presence of BlackRock, Microsoft, KKR, PIF, and other blue-chip or sovereign backers signals that AI infrastructure is now a priority asset class, and an increasing share of the action is going to happen on the private side;

A central pillar of the private credit thesis is that we’re entering a capital-intensive cycle, i.e. AI infrastructure. What’s different about this cycle is that it demands a degree of structure and underwriting that neither traditional private equity, nor public debt can supply. Put simply, the most important companies are investing around a new class of hard assets, where debt is a more efficient form of financing (relative to one-size-fits-all dilutive equity), but flexibility and creativity is necessary to get deals done. If you can only do trad equity and/or trad debt, you’re going to be on the outside looking in.

Investment Idea 💡

Is there alpha in human capital? Companies that have strong relationships with their employees outperform their peers. And it’s quantifiable and investable. So says JPM, with the release of their “Human Capital Factor.”

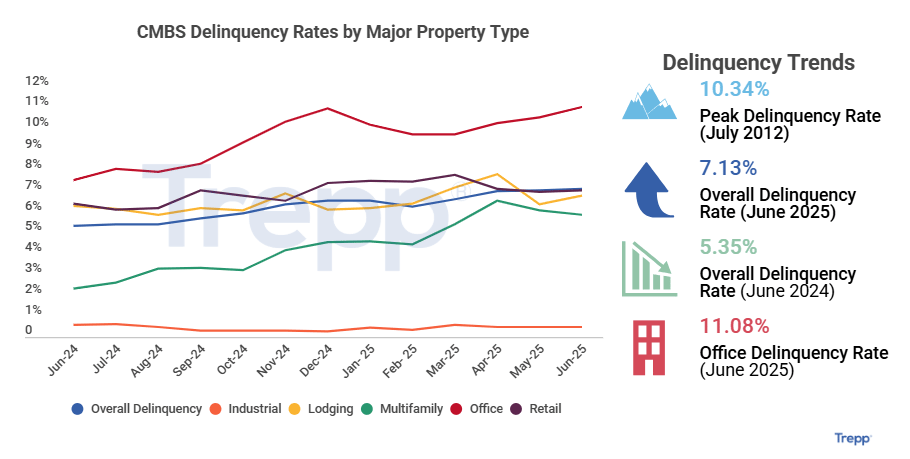

Office CMBS delinquency back on the rise

CMBS delinquency rates for Office have regained their Nov. 2024 peak

Why it matters:

Office stress is back at crisis-level: at 11.1 %, office delinquencies have blown past the 2012 post-GFC peak, confirming that the downshift in demand (due to remote-work, and flight from metro) is still very much in-play, and running headlong into a higher cost-of-capital market;

Contagion risk is rising: overall CMBS delinquencies jumped ~180 bp in a year to 7.1 %, closing in on the last cycle’s 10.3 % high—evidence that trouble is spreading from office into multifamily and lodging (which has been especially volatile), with widening implications for banks, insurers, and structured-credit investors.

Wide sector divergence = selective opportunity: industrial stays near frictional lows (~1 %), while retail and lodging hover around 6-8 %; the chart underscores that CRE pain is not uniform, guiding lenders and investors toward resilient subsectors and away from balance-sheet landmines.

There were some signs that Office was exiting its multi-year malaise, but progress went backwards, in the CMBS market, at least. The reality is that RTO has stalled-out, and while demand for Class A office remains strong, lower-quality and/or older assets remain under-pressure. That rates continue to stay high, while costs continue to rise (and rents go flat-to-down, even in multifamily) means we’re not out of this mess, yet.

Capital Markets for the Curious

Spread the gospel of Private Market Review

If you want better, smarter, capital markets content to thrive (like we do), then please share PMR with friends and colleagues.

Strategy, Trends & Analysis 📈

Continuation funds find their footing in Private Credit. Even credit is feeling the pain of slow distributions.

PE Fundamentals and a ‘valuation reckoning.’ PE-backed operating KPI are worse than public comps. So why are they held at relatively higher prices?

Why does nobody know how much energy AI actually consumes? AI will consume all the energy is one of the biggest trend theses out there. It turns out that it’s a bit more complicated than “AI will consume all the energy.”

Powering the AI Era. Goldman reiterating the ‘energy is the bottleneck’ AI thesis.

Benchmarking the Figma S-1. The next hottest tech IPO just filed their S-1. A quick look at what’s underneath the hood (it’s pretty impressive).

Outlook for the dollar. Apollo thinks the dollar decline was driven by hedging, and not a reallocation. Fade the ‘Fade America’ trade.

BlackRock tried private credit before. Will this time be better? A culture and strategy clash ruined the last try. Now BlackRock is trying to do things its way.