- Private Market Review

- Posts

- Middle Market Earnings Boom

Middle Market Earnings Boom

Plus data and takes on AI and Infrastructure Capex, silver-linings in liquidity, and niche real estate insights

The Big Picture in private capital markets

Middle market earnings boom

AI Capex Getting Bubbly

‘Down Round IPOs’ the new-normal

Plus:

allocators making changes

out with an old buzzy alt strategy, and in with the new

data, charts, and analyses on infrastructure, foreclosures, niche multifamily, LP sentiment, and VC benchmarks

Private Market Review is a free newsletter for the smartest GPs, LPs and Allocators to keep tabs on the growing universe of alts, and the rotation to private capital markets.

Middle-market earnings boom

Tech-cos grew earnings 17.3% yoy, per the Golub middle-market index

Why it matters:

Strong earnings growth for PE-backed middle market techcos (and healthcare) should assuage concerns about underlying distress

Earnings growth is also the single most important factor for valuation multiples

“Value Creation” is the new PE-playbook, and if they’re doing it right, earnings growth is exactly what you’d expect to see

Whether it’s AI and/or good old-fashioned business improvements, accelerating earnings is exactly the proof-point that PE needs to move forward. Forward earnings multiples are historically high in both public and private markets, so it’s a good sign for asset values, but it’s also some evidence that PE is more than just “small caps with leverage.” In all events, for all those unsold portfolio companies, ‘extend n’ pretend’ may well prove to be the winning strategy.

AI Capex is Getting Bubbly

Infrastructure Capex as a % of GDP has passed the Dotcom era (but still lags the Railroads by a lot)

Why it matters:

AI CapEx has now reached a scale commensurate with some of the largest industrial endeavors in the history of the country

It will certainly be worth it, if AI has the same relative impact of the internet and/or the railways, but for now, that’s a big “if”

Regardless, one big difference between data centers, on the one hand, and railroads and cable, on the other, is that the useful life of the latter spans into the decades, while data center obsolescence may only be a few years.

AI is undoubtedly the CapEx cycle now, and it is proceeding at historical scale. The good news is that it’s largely been paid for with BigTech free cash flow, which limits some of the damage in the event investment gets over-extended. The “bad news” is that, regardless of what one thinks of AI, there’s an open question as to whether data centers, or the foundation models themselves, will endure long enough justify their cost.

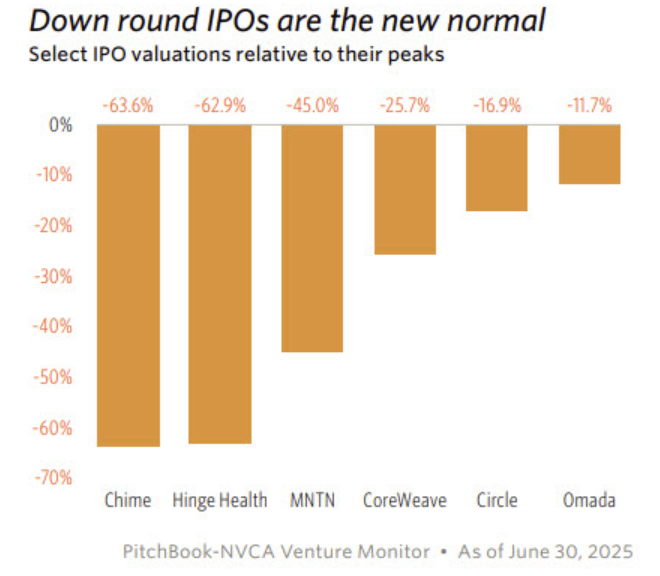

IPO Down Rounds are the New Normal

Recent IPOs have uniformly priced below their peak private valuations:

Why it matters:

The IPO market is wide open, but that doesn’t mean all private market investors are getting paid

This is nonetheless a healthy correction from the peak “ZIRP” fundraising climate—going public on a down-round was taboo, but down-rounds were a “when,” and not an “if”

The haircut is mostly explained by the fact that earnings growth sells, but revenue growth does not

The lack of exits on the private side have nothing to do with an “IPO problem.” The problem has always been a bid-ask spread: exit liquidity is there, provided sellers are willing to take a haircut on the obscene prices paid back in ‘21-’22. Down-round IPOs were inevitable, but it’s a good and healthy step forward to normalizing valuations and injecting more liquidity into the ecosystem.

Capital Markets for the Curious

Spread the gospel of Private Market Review

If you want better, smarter, capital markets content to thrive (like we do), then please share PMR with friends and colleagues.

Headlines 📰

Wall St. is Investing Billions in Marinas for Bigger Yachts. Asset-backed strategies find big assets to back.

Moody’s Raises Argentina’s Rating On Macroeconomic Reforms. Another big W for Milei.

University of CA ditches hedge funds with ‘scathing rebuke.’ Instead of alpha, hedge funds have been mostly beta. So says the University of California, at least.

Investors face losses on top-rated commercial mortgage debt. Investors in European commercial mortgage debt originally sold with a top credit rating are facing losses for just the second time since the global financial crisis . . . The valuation of a suburban Paris office building that serves as the headquarters of IT group Atos has been slashed amid troubles at the debt-laden tenant and a weakening office market. Holders of a mortgage security backed by the eight-storey River Ouest property, including those who own the formerly triple-A rated senior tranche of debt, could now receive payouts at less than face value.

Oregon taps new Alts head. A $95B retirement fund gets a new private market lead.

Tiger Grandcub rebounds 30 points after an early-year slump. A big bet on recycling turns a zero into a hero (for now).

Family offices are betting on the sports boom, from fantasy to pickleball. Go with what you know, maybe?

Trump weighing effort to remove capital gains tax on home sales. The idea is to lower the barrier to home sales.

Art is the worth performer. The most recent private markets craze fizzles out, as expected. Making scarce things valued for their scarcity a little less scarce tends to have that effect.

Investment Idea 💡

SNAP’s quiet revival. One investor makes the case that Snap $SNAP ( ▼ 4.28% ) has been rapidly gaining users and converting them the paid tier right under our noses. It currently trades at ~1/8th its all-time-high.

Strategy, Trends & Analysis 📈

The most interesting, data-driven, and/or incisive perspectives

Dramatic shift in secondary market, as continuation vehicles go mainstream. Pass the baton continues apace.

Deutsche Bank on the Energy Transition, Utilities, and Grid. A big sleepy industry that mostly trades at a discount is getting ready for historically high investment flows.

The best places to buy small multifamily buildings. A multi-factor analysis of what makes a good market for small multifamily, with some surprising results.

Schroders Equity Lens. What does performance look like in a stagflationary environment?

KKR Midyear Outlook: Make Your Own Luck. KKR revisits its 2025 ‘regime change’ themes, with focus on capital-intensity, re-shoring, opportunities abroad, and the macro setup generally.